Crowdfunding Has Grown Up and Is Here to Stay

Crowdfunding in the commercial real estate space has steadily evolved since passage of the JOBS Act and now represents a viable way to capitalize the equity side of a deal. Institutional-quality platforms have grown considerably in recent years and continue to gain market share. In our “Intro to Development Deal Structuring” blog, we covered several […]

Intro to development deal structuring: How to get in the game

Aspiring developers often inquire how they can stay invested in a development deal long term, rather than selling the project upon approval or completion. Deals that successfully structure this outcome take advantage of imputed equity and developer partnerships, while also managing the expectations of GP, co-GP, and/or LP equity.

Apartment Construction Financing Struggles

Headwinds for Apartment Development Fident has been fortunate to work with many capable multifamily developers throughout the western United States. As we enter 2018, nine years into the current up-cycle, changes in the capital markets’ landscape makes financing apartment construction more challenging. Those challenges most prevalent the current financing landscape include: Lender caution equates to […]

Housing Affordability: National Housing Trends

At a macro level, the U.S economy is on a hot streak. Now into month 100 of the current economic expansion (the 3rd largest in recorded U.S. History), the unemployment rate is flirting with 4.10% as of November 2017, in sync with extremely low jobless claims not seen since the 1970’s, and consumer confidence is […]

Entity Funding – Investors and Developers

Commercial property investors, and their unique cousin, the developer, often get to (or start at) a point where real estate investment halts without the infusion of additional risk capital. It’s that dynamic, at least partially, which creates the market that we serve. Typically, we do so by engaging on single projects with qualified operators to […]

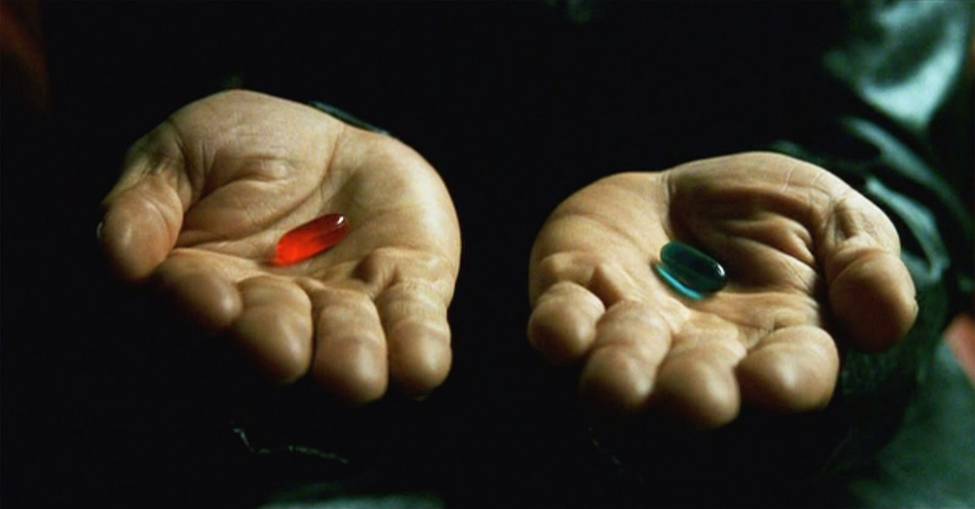

What Free Optionality Brings to Real Estate Investing

I’ve come to understand that a principled commitment to some vital business concepts provides substantial leverage and a competitive edge. Optionality, and its special relative free optionality, is one such concept. Here, I endeavor to define the terms, bring them into relief with real world examples, and illustrate some applications of free optionality within real […]

New Strategic Focus And Implications For San Diego

At times, there are changes in our great nation’s strategic planning that can have massive implications for the local economy that go largely unnoticed until they play out. At a recent economic forecast by the Institute of Real Estate Management, Terry Magee, a former senior officer of the United States Navy who subsequently held high […]

Metacognition: Key to Success in Real Estate Development World?

After eighteen plus years in the real estate development and capital markets, I have seen both massive successes and failures on the part of real estate developers. As a person who has a degree in medieval history and has never lost a passion for historical studies (yes, I am a history nerd), I naturally developed […]

Affordable Housing: Good intentions But Wrong Approach

With Fident’s relocation to a downtown San Diego office, I find myself driving by the high-rise affordable housing project Ten Fifty B every day. This 23-story, LEED Gold, concrete, glass, and steel tower is really something. The architecture is good and it offers some of the best views of the city, the Pacific, Balboa Park, […]

Maquiladoras: Subsidizing San Diego’s Industrial Sector

At an estimated population of nearly five million, the San Diego-Tijuana MSA is one of the United States largest bi-national conurbations. Accounting for approximately 40% of the USA/Mexico border population, it is one of the nation’s most populous and productive cross-border partnerships. In 2014 the region generated an estimated GDP of $230 billion, stacking an additional […]