ALTA endorsements can be a confusing piece of the closing process in commercial real estate, yet they are incredibly important and often requested by lenders to ensure protection for the asset, lender, and borrower alike. While standard title insurance policies provide foundational coverage, they rarely address the specific risks and complexities inherent in commercial real estate transactions. This gap creates potential exposure that can prove costly if unexpected title issues arise.

The American Land Title Association (ALTA), founded in 1907, has developed standardized endorsement forms to address these specialized needs.¹ The current ALTA forms collection is based on 2021 versions, with most core policy forms effective July 1, 2021, though individual endorsements continue to be updated with new forms as recent as August 2025.² Commercial real estate developers typically encounter a core set of commonly required endorsements.

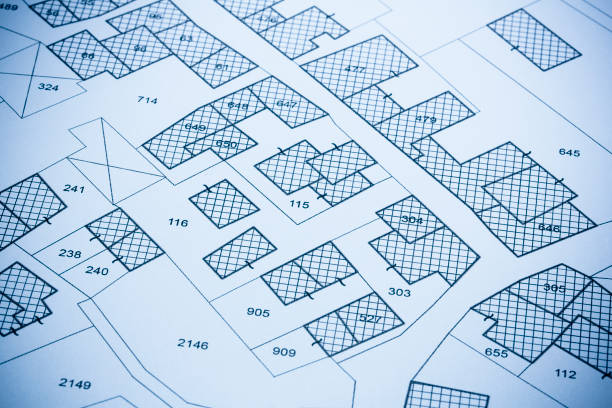

These endorsements typically arise during the ALTA survey process, a third-party report initiated by either the lender or borrower that provides a detailed land parcel map and outlines findings regarding zoning, access, improvements, utilities, and other relevant information that may impact the marketability of title. Let’s examine the most common ALTA endorsements and their practical applications in commercial real estate transactions.

What Are ALTA Endorsements and Why Do They Matter?

ALTA endorsements are addendums to title insurance policies that provide specific coverage beyond the standard protections offered by the base policy. They are designed to address various concerns and contingencies that may arise during real estate transactions, essentially allowing insureds to receive insurance against risks that would ordinarily be excluded by standard policy terms.

Title insurance is issued using standardized forms of policies and endorsements, with the most commonly used forms for commercial properties being those promulgated by ALTA.¹ A title endorsement is an addition to or limitation of title insurance coverage that is attached to a title insurance policy, providing coverage that tailors the policy to fit the needs of the insured for a specific transaction.¹

The standard title insurance policy alone is rarely adequate for most real estate transactions and almost always needs to be expanded through specific title insurance endorsements based on the specific risks related to the property in the loan transaction.² This is particularly true in commercial real estate, where transactions involve larger sums, more complex property uses, and greater potential for specialized risks.

Endorsements provide coverage for matters which would ordinarily be excluded by the standard policy’s exclusions from coverage, or excepted from coverage shown in the policy schedules. While endorsement forms are standardized, requirements for each vary, making it important that parties understand the underwriter’s specific requirements to issue particular endorsements and provide ample lead time to fulfill these requirements.¹

The Most Common Commercial ALTA Endorsements

Commercial real estate transactions typically require a core set of endorsements that address the most frequent concerns in sophisticated property deals. Understanding these common endorsements helps borrowers and their advisors prepare for typical lender requirements.

Zoning Endorsements (ALTA 3 Series)

Zoning endorsements provide affirmative coverage of the applicable zoning classification and allowed uses, making them essential for commercial properties where zoning compliance directly impacts property value and usability.

The current 2021 ALTA zoning endorsement series includes several forms designed for different situations:²

ALTA 3.1 (Zoning – Completed Structure) is used for improved property and provides insurance as to the zoning classification and permitted uses, along with coverage if existing structures don’t comply with zoning requirements.²

ALTA 3.2 (Zoning – Land Under Development) applies to land that will be developed with new improvements and insures the zoning for projects built according to referenced plans.²

ALTA 3.3 (Zoning – Completed Improvement – Legal Non-Conforming Use) addresses properties with legal non-conforming uses, which was updated in 2024.² This endorsement confirms that although the current use may not conform to current zoning, it has protected status as a legal non-conforming use that can continue.

ALTA 3.4 (Zoning – No Zoning Classification) is available for areas without formal zoning classifications, common in rural areas or certain states with limited land use regulation²

Environmental Protection Endorsements (ALTA 8.1)

Environmental endorsements provide coverage against recorded environmental liens that could cloud title or create cleanup liability.

ALTA 8.1 (Environmental Protection Lien) is the current 2021 form that addresses both residential and commercial real estate transactions.² The previous system that had separate endorsements for residential (8.1) and commercial (8.2) properties has been consolidated. This endorsement insures against loss or damage sustained by reason of environmental protection liens recorded in public records as of the policy date.⁴

It’s important to understand that this endorsement does not insure that the land is clean or free from environmental contamination—it only protects against recorded environmental liens.⁴ This distinction is crucial for borrowers who may mistakenly believe environmental endorsements provide broader environmental coverage.

Mechanics’ Lien Endorsements (ALTA 32 Series)

Mechanics’ liens can cloud title and create complications during property sales or financings, making these endorsements particularly valuable for construction and renovation projects.

The current ALTA 32 series includes ALTA 32 (Construction Loan), ALTA 32.1 (Construction Loan – Direct Payment), and ALTA 32.2 (Construction Loan – Insured’s Direct Payment), all in 2021 versions.² These endorsements protect against losses resulting from mechanics’ liens filed against construction projects, with different structures depending on the payment arrangements between lenders, borrowers, and contractors.

How Endorsements Impact Transaction Costs and Timing

Understanding the cost and timing implications of ALTA endorsements helps borrowers plan effectively for closing requirements and avoid last-minute surprises that can delay transactions or increase costs.

Cost Considerations: Some endorsements are available at no additional charge, while others carry fees that may vary by title insurance underwriter.⁴ The cost often depends on the complexity of underwriting required and the additional risk assumed by the title insurer. Borrowers should budget for these costs early in the transaction planning process. The cost structure typically follows a tiered approach based on the level of underwriting required. Simple endorsements that rely on existing policy information might cost $100-$500. Endorsements requiring attorney opinions or additional searches might cost $1,000-$5,000. Complex endorsements like comprehensive zoning coverage for large developments can exceed $25,000. These costs are in addition to the base policy premium and can significantly impact closing costs

Timing Requirements: Different endorsements have varying underwriting requirements that can impact closing timelines. For example, zoning endorsements may require attorney opinions prepared by counsel experienced in zoning matters, along with careful review of county zoning ordinances and amendments.⁶ Survey endorsements require current ALTA surveys, which can take several weeks to complete.

Due Diligence Integration: Many endorsements require specific due diligence items that should be ordered early in the transaction process. ALTA surveys, zoning opinions, environmental assessments, and other required documentation should be initiated promptly to avoid closing delays.

The key is providing ample lead time to fulfill underwriting requirements, as rushed endorsement requests can delay closings or result in declined coverage.¹

Strategic Considerations for Borrowers

Borrowers can take proactive steps to manage endorsement requirements and costs effectively.

Early Assessment: Work with experienced counsel and title professionals early in the transaction to identify likely endorsement requirements based on property type, intended use, and lender preferences. This allows for proper budgeting and timeline planning.

Risk Evaluation: Consider whether specific endorsements provide value proportionate to their cost. While lenders may require certain endorsements, borrowers should understand what protection they’re receiving and whether additional optional endorsements might be beneficial.

Documentation Coordination: Ensure that surveys, zoning opinions, environmental assessments, and other required documentation meet the specific requirements of intended endorsements. Having documentation prepared to endorsement standards from the outset prevents delays and additional costs.

Lender Communication: Discuss endorsement requirements with lenders early in the process to understand their specific requirements and any flexibility in endorsement selection. Some lenders have standard endorsement packages, while others may negotiate based on property characteristics and transaction structure.

Common Pitfalls and How to Avoid Them

Several common issues can complicate endorsement procurement and increase transaction costs.

Inadequate Survey Specifications: Ordering surveys that don’t meet ALTA standards or lack required Table A items can necessitate resurveys, causing delays and additional costs. Ensure surveyors understand specific endorsement requirements before beginning fieldwork.

Timing Misalignment: Waiting until late in the closing process to address endorsement requirements often leads to rushed due diligence, higher costs, or declined coverage. Begin endorsement-related due diligence as early as possible in the transaction timeline.

Misunderstanding Coverage: Borrowers sometimes misunderstand the scope of endorsement coverage, leading to surprise gaps in protection. For example, environmental endorsements protect against recorded liens but not actual contamination. Carefully review endorsement language to understand coverage limitations.

Incomplete Documentation: Failing to provide complete information to title insurers can result in declined endorsements or coverage exceptions. Work with experienced professionals to ensure all underwriting requirements are satisfied completely and accurately.

Conclusion

ALTA endorsements play a crucial role in facilitating smooth commercial real estate transactions and safeguarding investments in complex property deals. While the standard title insurance policy provides important foundational protection, endorsements address the specific risks and concerns that arise in sophisticated commercial transactions.

Understanding common endorsement requirements allows borrowers to plan proactively for closing costs and timelines while ensuring they receive appropriate protection for their specific transaction risks. The key to successful endorsement procurement lies in early planning, proper documentation, and working with experienced professionals who understand both endorsement requirements and underwriting standards.

As commercial real estate transactions continue to evolve in complexity, ALTA endorsements provide valuable tools for addressing specific concerns and contingencies relevant to each transaction. By providing enhanced protection, mitigating risks, and ensuring the marketability of title, these endorsements help facilitate successful closings while protecting the interests of all parties involved.

Remember that endorsement availability and requirements can vary by jurisdiction and title insurer, making it essential to work with local professionals familiar with regional practices and requirements. Proper endorsement planning from the transaction’s outset helps ensure smooth closings while providing the protection necessary for successful commercial real estate investments.

The ultimate goal of endorsement procurement is achieving appropriate risk protection at reasonable cost within transaction timelines. This requires balancing lender requirements, risk assessment, and economic considerations while maintaining focus on the transaction’s business objectives. With proper planning, clear communication, and experienced guidance, the endorsement process can proceed smoothly, providing the protection necessary for successful commercial real estate investment.

Sources:

- Williams Mullen. “Title Endorsement Basics.” November 2024.

- American Land Title Association. “Policy Forms.” Official ALTA Website, 2024.

- American Association of Private Lenders. “Title Policy Endorsements 101.” November 10, 2020.

- Corporate Settlement Solutions. “The Top 6 Commercial Loan Policy Endorsements to Protect a Lender.” March 20, 2024.

- Stoll Keenon Ogden PLLC. “Why get an ALTA Survey?” August 25, 2017.

- Agents National Title. “Zoning Endorsement, Expanded (ALTA 3.1): Underwriting Guidelines.”