San Diego’s Multifamily Market Shows Little Signs of Cooling as Cap Rates Remain Compressed.

Introduction

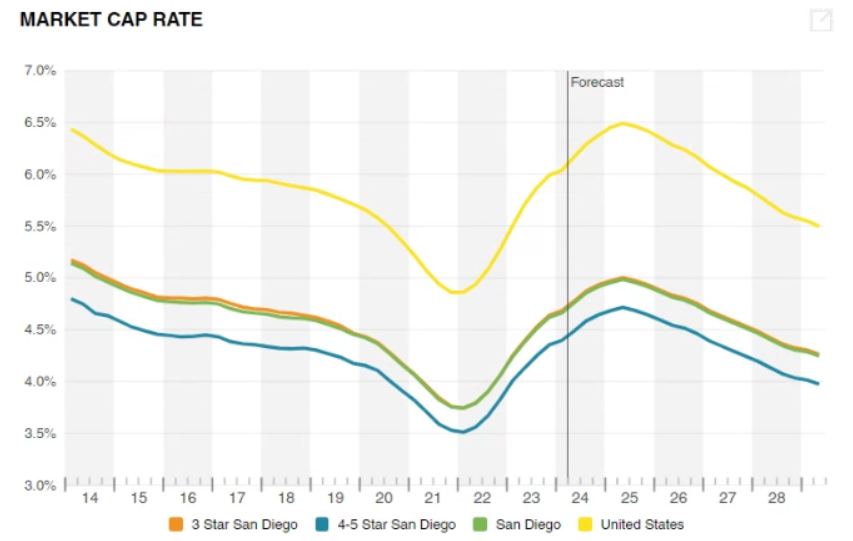

While the real estate market in San Diego has seen significant transformations over recent years, some things remain the same, notably the persistently low cap rates. As of May 2024, major trades in the San Diego market average just 4.6%, markedly lower than the 6.0% average cap rate nationally. While many equity funds and lenders have been significantly raising exit cap rate assumptions in reaction to higher interest rates, often projecting exit cap rates based on spreads to U.S. treasuries, the data shows that cap rates remain compressed in the San Diego market. This blog explores the factors driving this trend, its implications for investors, and the broader economic context.

Understanding Cap Rates

The capitalization rate, or cap rate, is a key metric in real estate used to reflect the return on a property. It is calculated by dividing the property’s net operating income (NOI) by its cost. A valuation tool, a lower cap rate generally indicates a higher property value relative to its income, often suggesting a more competitive or stable market. Conversely, higher cap rates can indicate higher risk or lower property valuations.

Capitalization Rate = Net Operating Income / Value of Property

San Diego’s Real Estate Landscape

San Diego’s real estate market, particularly for multifamily properties, continues to experience a highly compressed cap rate environment. As of May 2024, the average cap rate for multifamily property sales in San Diego is 4.6%, and just 4.4% for 4-5 star properties according to CoStar. This reflects a broader trend where cap rates across various property types, including industrial and office spaces, are also lower than national averages.

Look at these recent multifamily trades in San Diego from the past year. The evidence is clear, cap rates remain low:

| Sale Date | Property Name | Submarket | Units | Year Built | Sale Price | Price Per Unit | Cap Rate |

| Under Contract | Peter Rios Estates | Outlying Santee | 32 | 2019 | $14,395,000 | $449,844 | 4.66% |

| Mar-24 | Esplanade | Mira Mesa | 616 | 1986 | $212,141,374 | $702,827 | 5.25% |

| Feb-24 | Pulse Millenia | Otay Ranch | 273 | 2015 | $116,000,000 | $424,908 | 5.25% |

| Jan-24 | The Element | Bankers Hill | 28 | 2021 | $15,900,000 | $567,857 | 3.90% |

| Dec-23 | Palisade | University City | 300 | 2019 | $203,000,000 | $676,667 | 4.30% |

| Dec-23 | The Artisan | East Village | 265 | 2018 | $107,750,000 | $406,604 | 5.00% |

| Dec-23 | Margo at the Society | Mission Valley | 240 | 2021 | $125,500,000 | $522,917 | 4.75% |

| Sep-23 | The Q Lofts | Little Italy | 29 | 2010 | $34,200,000 | $1,179,310 | |

| Sep-23 | The Continental | Little Italy | 43 | 2019 | $21,350,000 | $496,512 | |

| Aug-23 | Contour Lofts | Little Italy | 27 | 2019 | $20,715,000 | $767,222 | 2.90% |

| Aug-23 | Jefferson La Mesa | La Mesa | 230 | 2022 | $111,000,000 | $482,609 | 4.50% |

| Jul-23 | Veranda La Jolla | University City | 354 | 1992 | $165,500,000 | $467,514 | |

| Jun-23 | Mr. Robinson Lofts | Uptown | 34 | 2016 | $28,215,500 | $829,868 | |

| Average | 190 | 2013 | $90,435,913 | $613,435 | 4.50% |

San Diego Multifamily Cap Rates vs. National Trends

San Diego’s multifamily cap rates are notably lower than the national average. Nationally, multifamily cap rates have seen an upward trend, up 40bpts year-over-year, with a national average market cap rate of 6.0% according to CoStar. In contrast, most multifamily deals in San Diego are transacting at sub-5% cap rates, and cap rate expansion in the past year has been more modest at 30bpts. This disparity is even wider when compared to many Midwest and sunbelt markets where cap rates have expanded to the 6.0-7.0% range. The disparity can be attributed to San Diego’s unique market dynamics, including its strong economic fundamentals, high demand, limited supply, and robust institutional investment, which collectively compress cap rates more than in other U.S. markets.

San Diego has historically been a highly compressed cap rate environment compared to national averages.

Factors Driving Low Cap Rates

Several factors contribute to the persistently low cap rates in San Diego:

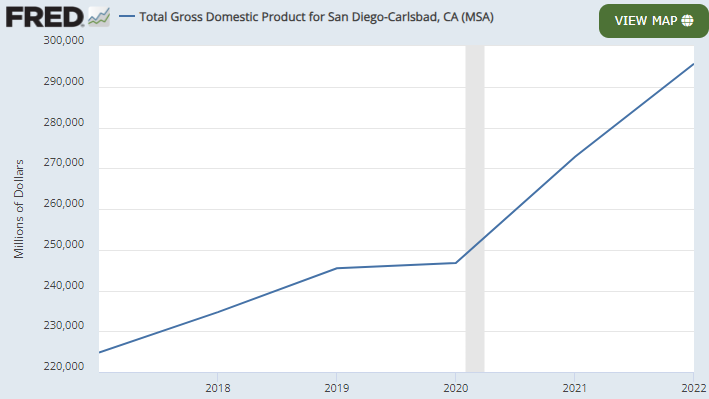

- Strong Economic Fundamentals: San Diego’s economy is robust, with steady job growth, particularly in tech and biotech sectors. According to HUD, San Diego’s area median income (AMI) reached $119,500 in 2024, marking a significant 38.5% increase in incomes since 2019. Concurrently, the region’s GDP has surged by 20% over the past two years, approximately four times the national growth rate. This economic strength supports higher property values as demand for housing and commercial spaces increases. According to CoStar, the multifamily sector’s cap rates are estimated at 6.0% nationally, but San Diego’s robust job market and economic fundamentals drive its cap rates lower.

San Diego’s GDP skyrocketed 20% between 2020 and 2022.

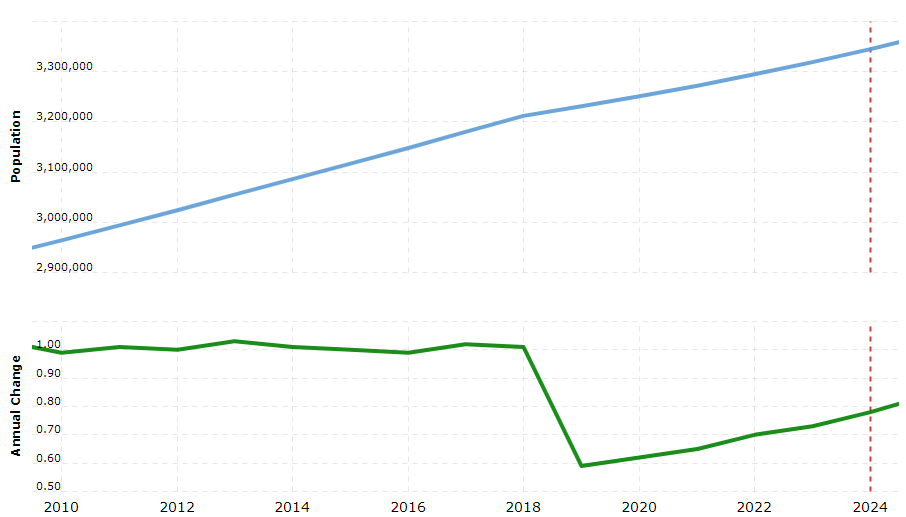

- Population Growth: The city has seen consistent population growth, roughly 10% growth since 2010, bolstering demand for both residential and commercial properties. This demographic trend supports lower vacancy rates and higher rents, driving property values up and compressing cap rates. Data from the S&P CoreLogic Case-Shiller Index shows a steady increase in home prices, with the highest year-over-year increases in the country, reflecting ongoing demand and limited supply.

San Diego metro area population growth since 2010.

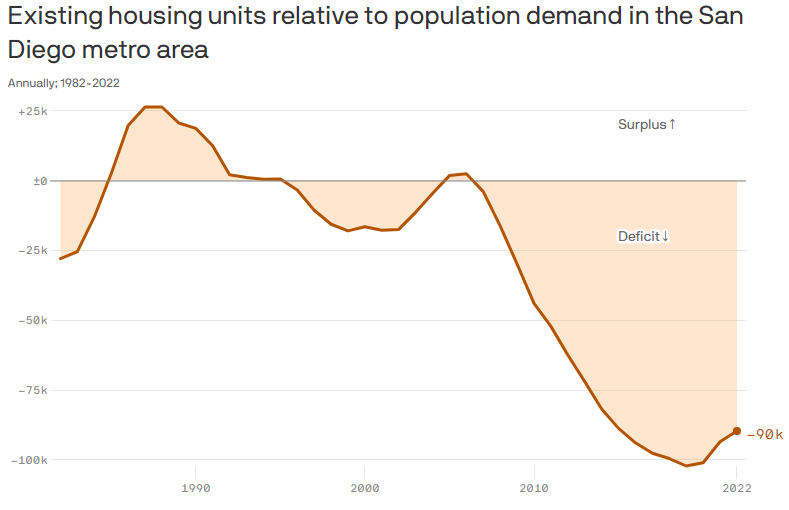

- Limited Supply and High Demand: San Diego’s geographic constraints limit the availability of developable land, creating a supply-demand imbalance. High demand coupled with limited new supply keeps property prices elevated. Reports from Newmark highlight that higher construction levels and impending deliveries suggest that vacancy rates might increase, but demand still outpaces supply. While vacancy rates average 7.7% nationally, in San Diego, vacancy is just 5.3%, creating heavier upward pressures on rents. According to a recent Hines analysis, it is estimated that San Diego needs to add 90,000 units of housing to solve the current supply and demand imbalance.

It is estimated the San Diego metro is short 90,000 units of housing.

- Institutional Investment: There has been a surge in institutional investment in San Diego’s real estate market. Institutional investors often accept lower yields in exchange for perceived stability and long-term capital appreciation potential. Blackstone has invested over $1B in San Diego multifamily over the past five years. Kidder Mathews reports that institutional buyers are driving competition, compressing cap rates further.

Palisade apartments in the University City submarket recently transacted at a 4.30% cap rate for $203MM (676k/unit)

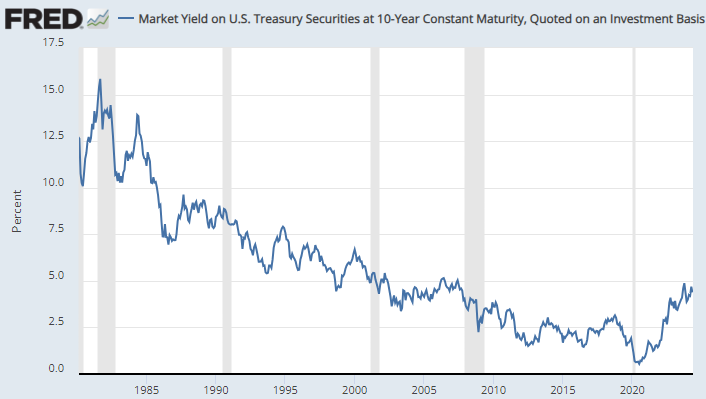

- Low Interest Rates: Although interest rates have risen from their historic lows, they remain relatively low by historical standards. This environment allows investors to finance properties at favorable rates, which can support higher valuations and lower cap rates. JLL’s research indicates that the low-interest environment continues to make San Diego an attractive investment destination despite rising rates.

Implications for Investors

The persistency of low cap rates in San Diego presents both opportunities and challenges for investors:

- Higher Entry Costs: Investors face higher entry costs due to elevated property prices. This necessitates larger capital outlays and can limit the pool of potential investors.

- Lower Initial Yields: With lower cap rates, initial yields on investments are reduced. Investors must rely more on future appreciation and rent growth to achieve their desired returns.

- Increased Competition: The attractiveness of San Diego’s market has led to heightened competition among investors, driving prices higher and keeping cap rates compressed. This strong buyer pool benefits owners looking to sell, as they can sell into a highly competitive market.

- Reduced Volatility: The high demand from investors in San Diego keeps cap rates consistently low, which helps insulate property values from economic fluctuations and changes in market conditions. This creates a stronger risk-adjusted return profile, making investments in the multifamily sector more stable and attractive. This stability is particularly appealing in uncertain economic times when other investment avenues might be more volatile.

Equity Funds and Treasury Spreads

The 4.6% average cap rate in San Diego is significantly lower than the assumptions many equity funds are currently underwriting in their internal models. This discrepancy highlights the competitive nature of the market, and the premium investors are willing to pay for San Diego properties. Moreover, the spread between cap rates and treasury yields has narrowed, challenging traditional investment models that rely on wider spreads to justify real estate investments.

Broader Economic Context

The broader economic context also plays a crucial role in cap rate dynamics. Factors such as inflation, monetary policy, and economic growth expectations influence investor behavior and real estate valuations. For instance, expectations of continued economic growth and stable monetary policy can sustain low cap rates by supporting high property valuations.

Conclusion

The persistently low cap rates in San Diego is a multifaceted phenomenon driven by strong economic fundamentals, income growth, limited supply, and robust institutional investment. While this presents challenges in terms of higher entry costs and lower initial yields, it also underscores the attractiveness of San Diego as a stable and desirable investment market. Investors must carefully consider these dynamics and adjust their strategies to navigate this competitive landscape effectively.

For those looking to invest in San Diego’s real estate market, understanding these trends and their underlying causes is crucial. The current environment requires a keen eye for property valuation, a readiness to compete with institutional players, and a long-term perspective on investment returns.

—

At Fident Capital, we work closely with developers and investors to navigate the capital markets and secure debt and equity financing. Visit us to connect and learn more about other real estate topics.

References

- S&P CoreLogic Case-Shiller Index, Federal Reserve Bank of St. Louis

- Kidder Mathews, “San Diego Multifamily Market Report Q1 2024”

- Newmark, “San Diego Real Estate Market Reports”

- CBRE, “A Multi-perspective View on Cap Rates”

- JLL, “San Diego Office Insight Q1 2024”

- Freddie Mac, “2024 Multifamily Outlook”

- Marcus & Millichap, “2024 U.S. Multifamily Investment Forecast”

- Mashvisor, “San Diego Real Estate Market Trends in 2023”

- CapRateIndex, “Cap Rate in San Diego CA”

- Axios, “San Diego’s housing shortage explained in one chart”