San Diego’s multifamily real estate market has experienced an extraordinary surge over the past decade, characterized by a remarkable 57% increase in average asking rents, significantly outstripping the national average increase of 40%. Such impressive growth is a testament to San Diego’s real estate landscape’s robust demand dynamics and immense investment potential. While several other markets nationally struggle with oversupply, San Diego shines with strong fundamentals and a bright outlook for multifamily investments. Here are five core reasons why investors are flocking to San Diego’s multifamily sector:

Why Invest in San Diego Multifamily – Five Key Factors Fueling Demand and Growth:

Persistent Supply-Demand Imbalance

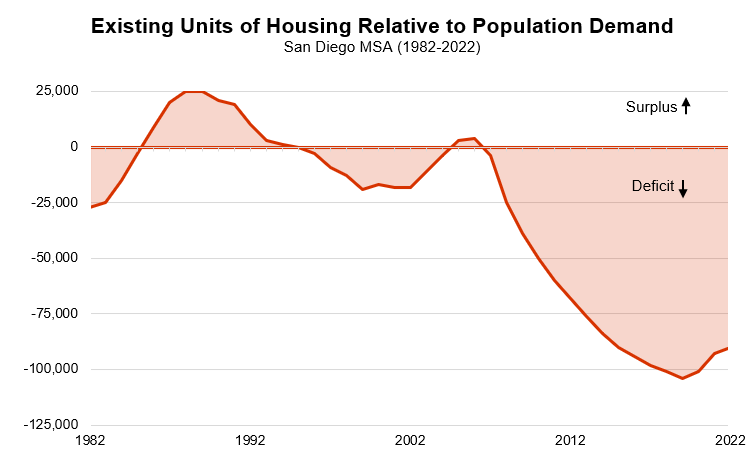

At the core of San Diego’s real estate appeal is the persistent imbalance between housing supply and demand. While the city has experienced commendable population growth, approximately 10% since 2010, the city faces a significant housing unit shortage. It’s estimated that an additional 90,000 units are required to alleviate the strain on the rental market. According to state projections, to keep pace with demand, San Diego needs to construct about 13,500 new homes annually through 2029—a total of 108,036 homes. However, development has been stymied by restrictive zoning, high land costs, and soaring construction costs, with a mere 19,000 new units added in the past five years and only 4,200 units delivered in 2023. In essence, there is no quick fix. These challenges are further compounded by San Diego’s geographical constraints, making infill developments more critical, yet more complex and costly to execute.

San Diego’s current housing deficit is estimated at 90,000 units.

While it is tougher to build, developers who can navigate these hurdles are rewarded with favorable market dynamics—lower vacancy rates and minimal supply-side risk compared to most markets. These market dynamics drive high investor demand, generating a consistently compressed cap rate environment, even in down cycles, reducing downside risk for merchant developers and value-add investors. For long-term owners of San Diego multifamily, this has translated to annual rent growth of 5-6% over the past decade, driving outsized appreciation rates. This appreciation is compounded by CA Prop 13, which limits property tax growth to 2% annually, driving increased NOI growth and a more favorable expense ratio over the long-term hold.

Economic Vibrancy and Income Growth

San Diego’s economic landscape has dramatically shifted from its historical reliance on tourism and military bases to becoming a vibrant center for biotech, technology, and entrepreneurship. This diversification has catalyzed significant job growth, especially in high-value sectors, with non-farm employment in San Diego County expanding by an impressive 15% between 2010 and 2020—double the national growth rate. According to the U.S. Department of Housing and Urban Development, the median income in the San Diego area has surged 35%,from $86,300 in 2019 to $116,800 in 2023, notably outpacing Los Angeles and San Francisco.

Pfizer recently inked a deal to lease 230k SF of lab space at the new Torrey View campus in San Diego.

Often referred to as “Biotech Beach”, San Diego’s life science sector has grown immensely and is now the third largest market in the United States, increasingly competitive with the likes of Boston and San Francisco, and home to several major players including Pfizer and Illumina. Additionally, the technology sector has experienced remarkable growth, with Apple announcing a new 5,000 employee campus, joining the likes of Microsoft, Amazon, ASML, and others who have increased their presence in recent years. San Diego is on the forefront of the artificial intelligence tech boom, home to major players including Qualcomm, Oracle, and Crowdstrike, as well as newcomers such as Shield AI, which recently raised $500MM in funding.

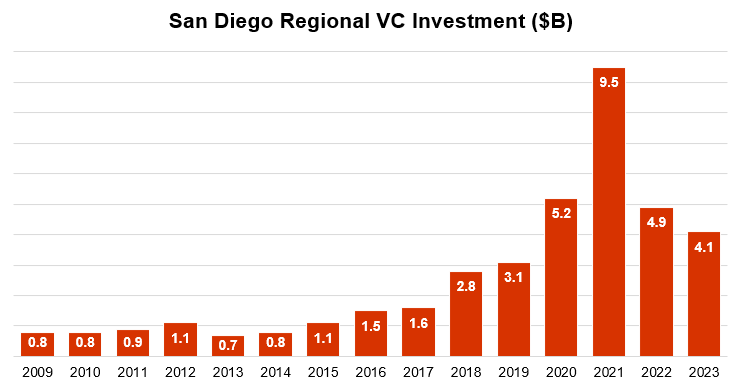

The growing venture capital scene in San Diego.

The venture capital scene in San Diego has also seen exponential growth, from averaging about $1 billion in 2010-2015, to nearing $10 billion in activity in 2021, now solidified among the top markets for VC investment. Despite a national downturn in venture capital activity post-2021, San Diego’s market has shown resilience, outperforming major metros including Austin, Seattle, Denver, and Washington D.C. These economic factors ultimately drive rental demand, further enhancing the market’s appeal to investors.

In-Migration from Costlier Metros

San Diego’s appeal transcends its local boundaries, attracting a steady stream of migrants from costlier metropolitan areas like San Francisco and New York. Drawn by the promise of comparatively lower living costs and a more relaxed lifestyle, coupled with the increasing prevalence of remote work post-pandemic, San Diego has emerged as a magnet for transplants from tech hubs. U.S. Census data reveals a net influx of over 20,000 domestic migrants to San Diego County annually since 2010, with net population gains strongest among those with graduate degrees. The rise of remote work has further amplified this trend in recent years. This migration of higher-income earners has not only contributed to intensifying demand for rental housing but also to increased demand and higher prices among for-sale product.

Based on Redfin data, Los Angeles, followed by San Francisco, New York City, Seattle, and Dallas, are the primary cities from which people are moving to San Diego.

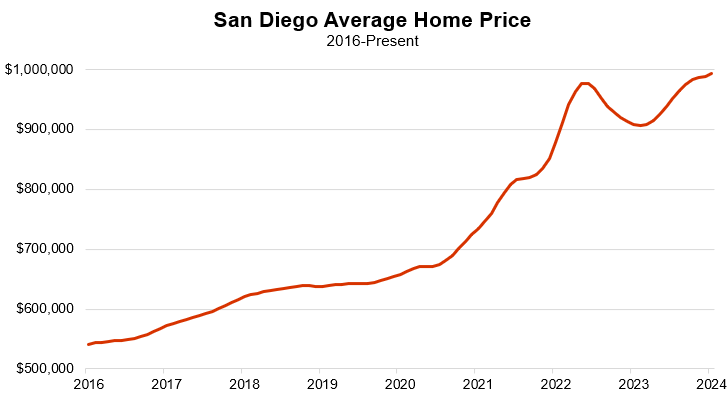

Surging Home Prices and Homeownership Unaffordability

Another strong contributor to the multifamily landscape is the unaffordability of housing. San Diego currently leads the nation in home price growth over the past year, up 11.2%, bucking the trend of softening prices seen in many other markets. With a median home price of $940k as of March 2024, the unaffordability of homeownership in San Diego has significantly contributed to the demand for multifamily units. Today, San Diego families need an income of nearly $275,000 a year to afford a mortgage on a median-priced home, with the median mortgage more than double the median rent. The high cost of homeownership has effectively trapped a large segment of the population in the rental market, exacerbating the already high demand for multifamily housing.

Home prices are up over 35% since pre-COVID, and a typical monthly payment has doubled.

Demographic Appeal and Educational Growth

San Diego’s inherent desirability, bolstered by its climate, culture, and demographic makeup, further drives demand for rental housing. With Millennials and Gen Z making up 56% of the population, the city appeals to a young, dynamic demographic seeking a higher quality of life. San Diego ranks as the second in the U.S. as having the highest concentration of millennials compared to the total population living in the metro area. This rental base of young adults is further supported by San Diego’s 10 major institutions of higher education, as well as a significant military presence, which employs over 150,000 in the region. With the multi-billion-dollar expansions of San Diego State University and UC San Diego currently underway, set to increase enrollment by over 20,000 students, the growing student population further contributes to the growing demand for housing.

Rendering of the new SDSU West campus expansion.

Future Outlook:

“America’s Finest City” emerges as a beacon of opportunity in today’s multifamily investment landscape. As the city continues to evolve and expand, savvy investors stand poised to reap the rewards of investing in one of nation’s most dynamic and resilient real estate markets. The combination of robust job creation and persistent housing supply constraints is projected to perpetuate upward pressure on rental prices for the years to come. For investors poised to capitalize on long-term gains, San Diego presents a compelling opportunity to enter a thriving rental market poised for continued appreciation.

Sources: CoStar, Globe St, Axios, Redfin, Zillow, San Diego Union-Tribune, Connect San Diego, SDSU, Apple Insider, City of San Diego, Fox 5 San Diego