The Setup

A few years ago I read a comment describing how real estate, unlike the stock market, is built on asymmetry. Asymmetry in local expertise, operational knowledge by market or product type, access to capital, and sometimes pricing knowledge for assets (not just what was paid, but why). Arbitrage in financial markets has become so much harder to find as inefficiencies have been driven out ruthlessly by those seeking any improvement, no mater how small. The quest for knowledge and advantage in financial markets has led to some amazing changes in technology and the way it’s used, but real estate has not responded the same way. In large part, because it can’t. Real estate is the ultimate “local” business.

A big part of the asymmetry in real estate comes not only from local knowledge but from product knowledge. Basically, operational expertise and complexity. Capital actively moves toward real estate because it’s an asset you can see and touch and walk on, it generates cash flow, and leverage is readily available (“when banks compete, you win”). Capital always seeks the highest return for the lowest risk. The result is the “four food groups” and oceans of capital pursuing relatively low risk, cash flowing assets in easily understood arenas…apartments near job centers, office in the CBD, industrial near population centers that need distribution. As you would expect, the returns in these areas tend to be lower because they are well understood by lots of people and there is plenty of capital to buy, rehab, or build these projects. That drives up pricing and returns fall.

A Good Example: Seniors Housing

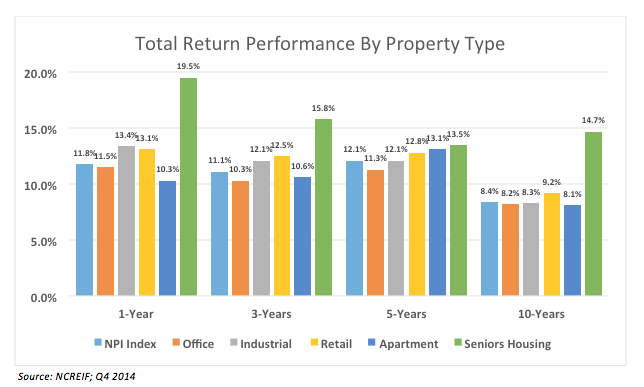

So where do you go to find higher return projects that the overall market may see but not understand or pursue? You look for asymmetry in knowledge, or complexity. Case in point: seniors housing. Over the last ten years this one class of real estate has performed consistently better than the others. According to NCREIF, seniors housing has outperformed every other major asset class for a one-year, three-year, five-year, and ten-year period.

The relatively small but expanding senior housing space is relatively new compared to other real estate segments. Back in the 1980s developers recognized the potential of serving a growing senior population. In the late 80s, the Department of Housing and Urban Development introduced a program to insure lenders against defaults, which caused a lot more money to enter the sector. Since then, this sector has increased to over $300 billion in size, though it is still only about half the size of the hotel market.

What Does the Sector Look Like?

At a high level, seniors housing is broken into four major categories: Independent Living, Assisted Living, Memory Care, and Skilled Nursing. The continuum of care increases across each segment type, with CCRS’s (Continuing Care Retirement Communities) providing the age-in-place model of multiple levels of care within one facility. As you move up from one facility type to the next, the level of care, as well as regulation, increases. The more care the residents require, the more these facilities move away from a real estate investment and into an involved operating business. Depending on the level of service, a senior housing facility may require up to five times the number of operating staff than a traditional multifamily project. This level of complexity, compounded by local, state, and federal regulations regarding construction and operation of these facilities and uncertainty about healthcare regulation and Medicare, has kept many investors from entering the space in much the same way that many investors avoid the hospitality sector.

We see a vibrant window of opportunity here for those with the knowledge and the will to pursue it. Not just because of expected continued demand, but also from the complexity of these operations and the impact a good operator can provide. For example, in many sectors of real estate, developers and investors have a pretty good idea what everything costs to build and operate. In multifamily you know what land, sticks and bricks, and soft costs are going to be within a pretty narrow range. You can also hire a third party to manage it for you for at a low cost. Your operational costs and projected profit are pretty well known. Compare that to hospitality, where you can build a facility, flag it to get good occupancy, and outsource operations to a management company, but from there the complexity of the operations and volatility from projections tend to rise. It’s in that complexity, which seniors housing offers in spades, that we see opportunity. The more levers there are to pull in day-to-day operations, the more critical the operator becomes, the less predictable the outcome, and the greater the opportunity to capture asymmetrical advantages.

Is This Sustainable?

Everyone has seen the statistics of the aging population and how demand for senior housing from the Baby Boom generation will undoubtedly increase. What comes as a surprise to many as they start looking into this sector is that we are only at the beginning. Baby boomers are those born between 1946 and 1964, making the front edge of that wave almost 70 years old. The average age of a resident in a senior living facility is 84 to 85 years old. Today’s facilities are really serving the parents of baby boomers. Clearly, demand is going to increase based on sheer numbers. It’s also important to note that the ratio of family caregivers to seniors is dropping. The AARP estimates that the ratio of caregivers aged 45 to 64 years old relative to the population of 80 years and older will fall from 7:1 in 2010 to 4:1 in 2030 and to less than 3:1 in 2050. This will make staying at home a less attractive option.

The demand drivers are compelling, the market size is increasing, and the asset class has started to garner real institutional appeal. In addition, the net growth of new properties has averaged roughly 20,000 new units per year over the last ten years; yet even during the Great Recession, absorption and asking rents never went negative. Absorption has tended to remain in line with new construction, on the whole.

With more facilities in the pipeline and demand increasing, absorption is driven not only by demographics but also operations. Savvy operators are critical to the financial success of the facility and this has been borne out by changes in operations. Historical data suggests seniors often just want to stay in their own homes. There is a perception that people in these facilities have nothing in common other than their age. By creating an environment that is more personalized and by treating residents more as guests, the level of satisfaction and overall experience improves. This improved experience also makes this type of housing a more attractive alternative to seniors earlier.

With independent living facilities now targeting seniors around 75 years of age, creating a better lifestyle choice than remaining at home is critical. In fact, many senior housing facilities are doing just that with the addition of on-demand meal service, more “homey” architecture with more use of natural light, and even pizza ovens or wine cellars. By creating a better lifestyle for them than they would have had staying in their homes, they create demand and start to pull seniors into their facilities at an earlier age while they are more independent and looking for amenities and access to activities they can’t get at home.

Yes, seniors housing requires larger and more highly trained staff, government regulation, operational expertise, as well as a full time kitchen, laundry operations, and multiple layers of complexity that push out many investors. This complexity may be welcomed by the astute investor willing to learn and master the space as it provides opportunity for a talented operator and/or investors to make attractive risk-adjusted returns that may outpace almost all other institutional real estate.

The senior housing sector, done right, offers an untapped potential. Here, you find positive demographic trends, improving access to capital, a balance in construction and absorption, increasing acceptance from seniors, and better returns than just about anywhere else in institutional real estate. We think it’s time to get involved more actively in senior housing.

________________________________________

1 NCREIF Trend Report, Q4 2014 and “AEW : Seniors Housing Investment Opportunity”, May 2015 (http://www.aew.com/pdf/AEWResearchSeniorsHousingInvestmentOpportunityMay2015.pdf).

2 “The U.S. Senior Housing Opportunity: Investment Strategies”. David Lynn, Ph.D. and Tim Wang, Ph.D., Real Estate Issues, Volume 33, Number 2, 2008.

3 National Investment Center for Seniors Housing and Care (NIC) and “AEW Research: Seniors Housing Investment Opportunity”, May 2015 (http://www.aew.com/pdf/AEWResearchSeniorsHousingInvestmentOpportunityMay2015.pdf).

4 “The U.S. Senior Housing Opportunity: Investment Strategies”. David Lynn, Ph.D. and Tim Wang, Ph.D., Real Estate Issues, Volume 33, Number 2, 2008.

5 “Exclusive Research: Outlook for Seniors Housing Sector Remains Bullish”, Beth Mattson-Teig, National Real Estate Investor, August 27, 2015. (http://nreionline.com/seniors-housing/exclusive-research-outlook-seniors-housing-sector-remains-bullish).

6 “5 Reasons to Consider Investing in Seniors Housing”, Beth Mace, National Investment Center for Seniors and Housing Care. June 3, 2015. (http://blog.nic.org/5-reasons-to-consider-investing-in-seniors-housing).

7 “Could Hospitality-Style, Multi-Purpose Senior Living Attract Younger Retirees?”, Alyssa Gerace, Senior Housing News, April 17, 2013. (http://seniorhousingnews.com/2012/04/17/could-hospitality-style-multi-purpose-senior-living-attract-younger-retirees/)